insurance-bot

Autonom8(A8) platform enables the enterprises to develop smart & adaptive workflows that places their customers at the center of their enterprise. Autonom8 offers a SaaS platform for enterprises to build & deploy intelligent, adaptive, conversational Customer Journeys.

A8Chat is conversation-centric and supports user interaction, orchestration across multiple steps integration with popular NLP tools (Dialog, Luis), escalation to/from a Live Agent, and adapters to numerous tools & services.

Insurance Bot

Modern Customer Needs

With the world moving more digital, consumers shop insurance online comparing quotes. The expectation of consumers are changing; if an agent isn't available for claim service or buy a new policy, they move on to another agency. In this modern age, policyholders and consumers want 24x7 support, personalised service, quicker response to queries with 0% waiting time and finally optimised mobile experience.

Meeting Customer's Needs

To meet the growing demand of consumers and policyholders, insurance companies will face the following:

- 24x7 Availability

- Managing Operational Cost

- Increasing Productivity

- Obataining good CSAT score

Bridging the Gap

With insurance chatbots leveraging powerful AI capabilities, both policyholders and agents save a lot of time and provide a better customer service experience. InsuranceBot can work as a personal insurance manager for each of your customers.

Customers have a lot of questions when it comes to choosing the right policy for their coverage needs or filing a claim can be cumbersome and when agents aren't available at this point, it makes things even worse.

Companies are making use of chatbots are gaining good business outcomes with increased customer satisfaction and loyalty, reduced operational cost and an increase in productivity. The feature benefits include claim processing, FAQs, payment assistance, assistance in buying a new policy, lead profiling etc.

Reasons to Consider A8Chat to Build Your Insurance Bot

Automated Customer Support for Similar Queries

There are some basic questions that users generally ask if you take the case of any insurance policy. These similar questions will have specific answers to be answered every time the user enquiries. A chatbot is the best way to answer these common questions.

Increases Productivity of Human Resources

Chatbots are available 24x7 and can be used to assist consumers with a specific task. Chatbots do not get bored or tired like humans and thus it will save some cost on customer support.

Improves Business Branding with Minimum Effort

With the competition in the market, customers are inclined towards a solution that requires minimum effort and an absolute solution. Chatbots are less prone to errors. Thereby providing a better customer experience that helps to build a better brand.

Accelerate Operations

Chatbots are not bound by limitations, like human agents. Human agents are capable of handling limited conversations whereas chatbots can operate limitlessly. Chatbots complement human tasks by boosting efficiency and reducing cost and effort.

Better User Interactions

Chatbots are the best tool for keeping users engaged by initiating and maintaining conversations. Chatbots show specific information at a time and however, the interaction gets advanced with a user based on the input to give better interaction and enhance the user's trust.

Cost and Time Effective

Engaging users becomes easy and quick with chatbots and also helps to convert potential leads into customers. The money spent on customer support will be less and save the business a decent amount of percentage. Since time is an important factor when it comes to business, the earlier you finish the development, the earlier you can execute strategies and do a market analysis for the business. The development time is reduced to weeks for chatbots when compared to an application development time of months leading to quicker deployment.

InsuranceBot Configuration

Botpress Introduction

An enterprise-grade tool for developing, deploying, managing and scaling your bots. Simple & intuitive, but as flexible as a bot made from scratch. Cloud-ready, and also available to install locally.

Users are required to log in using the credentials to access the botpress link. Administrators are only given access to botpress.

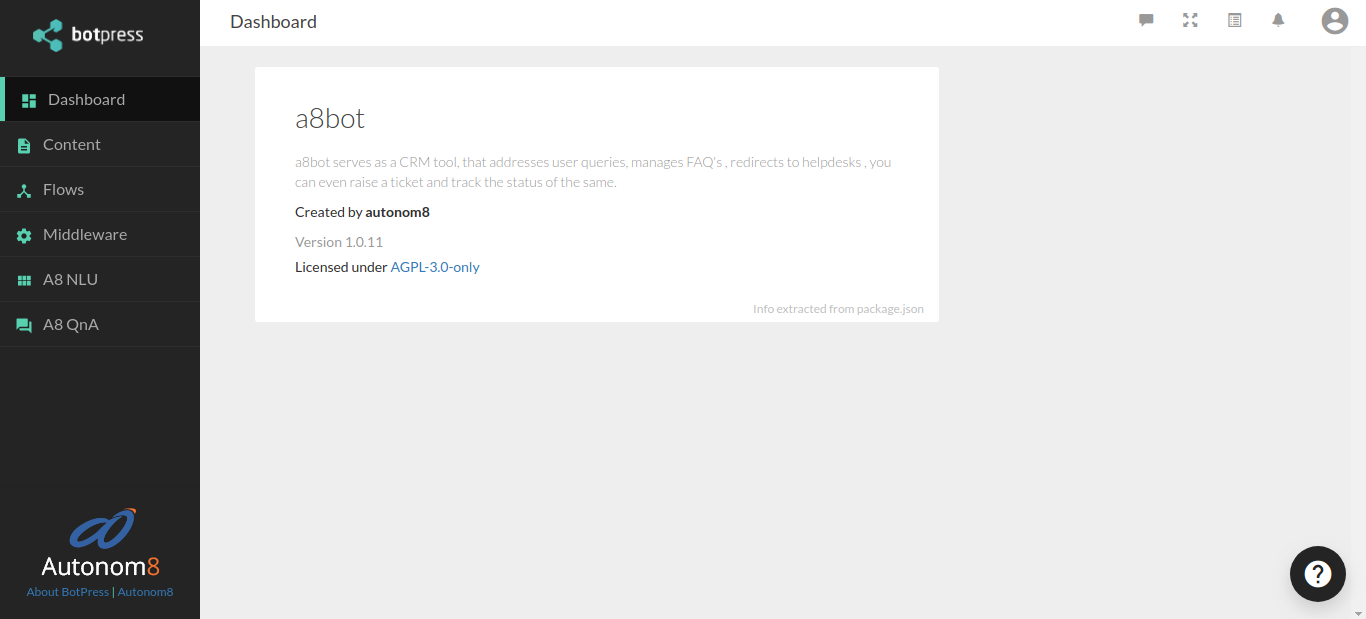

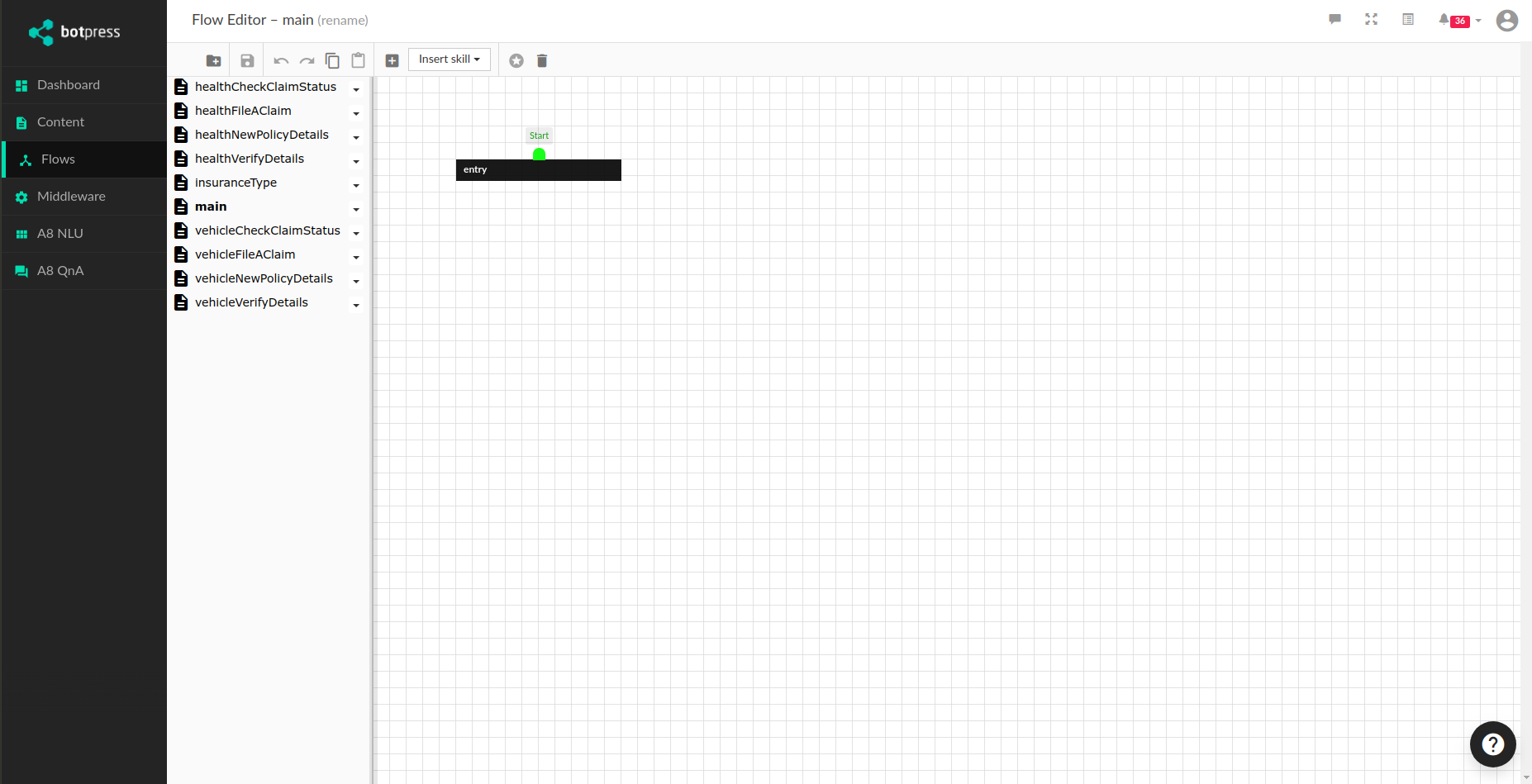

Once logged into the botpress, users can view the page as below and select Flow from the right panel.

Configuring NLP Queries

Not applicable for insurancebot.

Configuring Flow

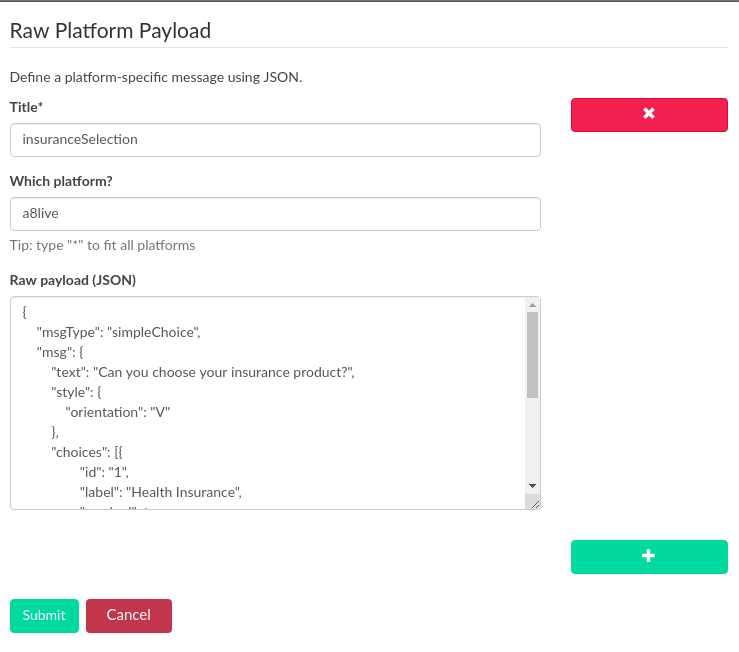

Configure Raw Payload

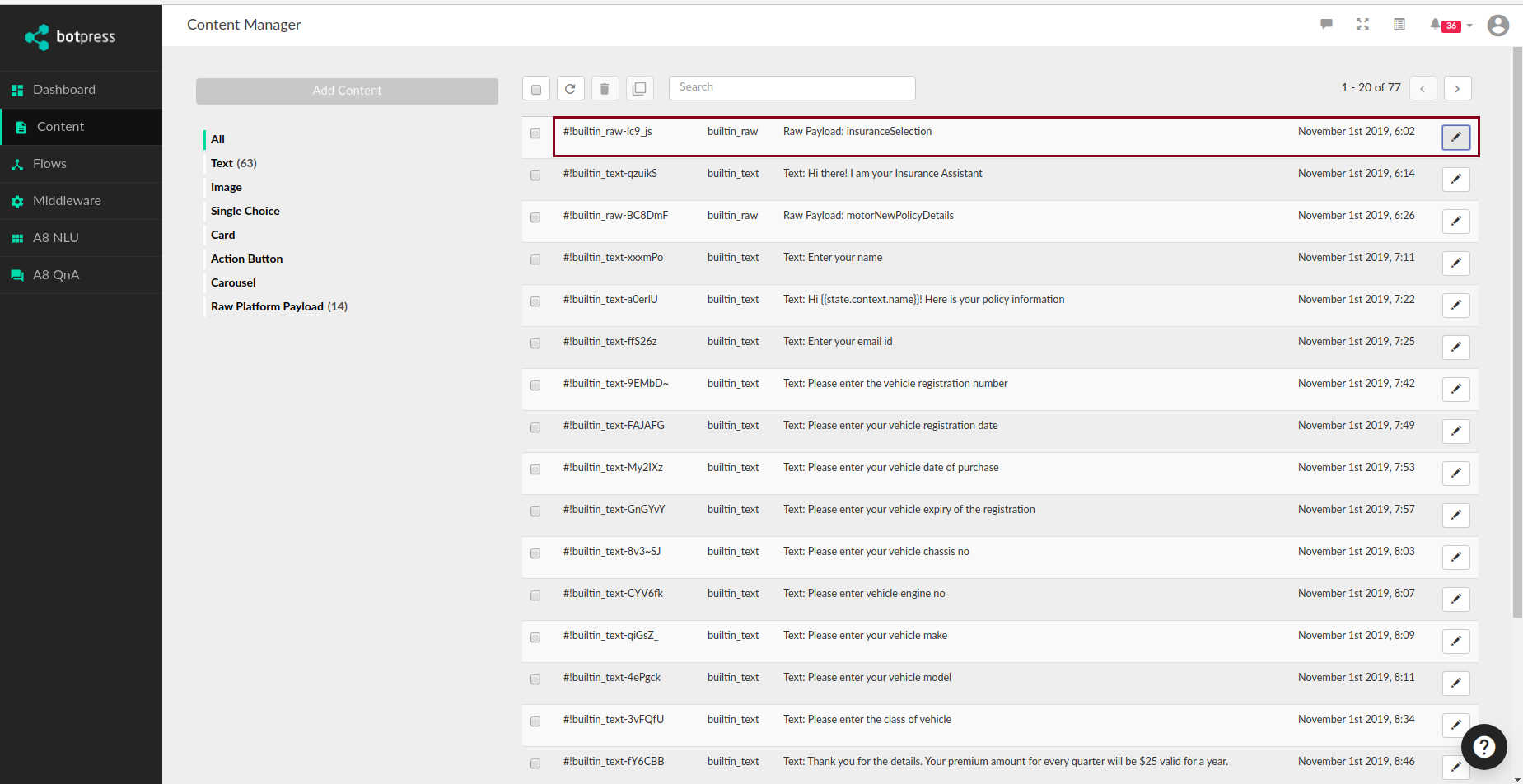

Step 1: On the left panel, click Content.

Step 2: Select Raw Platform Payload and Click Add Content.

Step 3: Click + and configure the following parameters:

- Title

- Which platform (just select the default value)

- Write JSON code in Raw Payload

Step 4: After entering all the details, click Submit.

ID(in the below screen) is the first field and it is to be mapped in A8Renderer configuraiton.

Main Node

There is a start node predefined in the botpress as shown in the below image. We need to add a new flow to begin configurations.

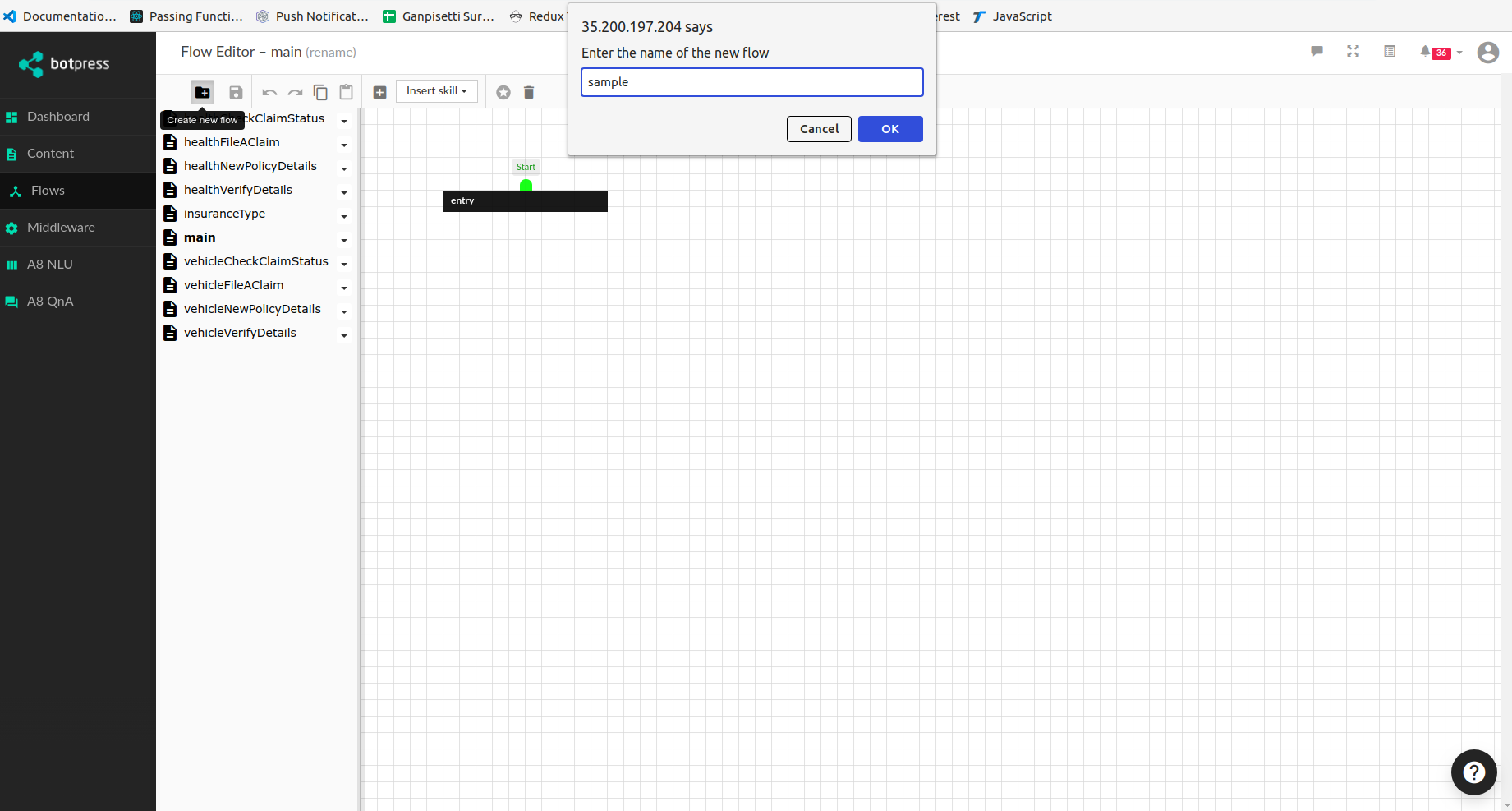

Add new flow

Click Create new flow, give a name and click OK. The new flow will be added onto the left side panel.

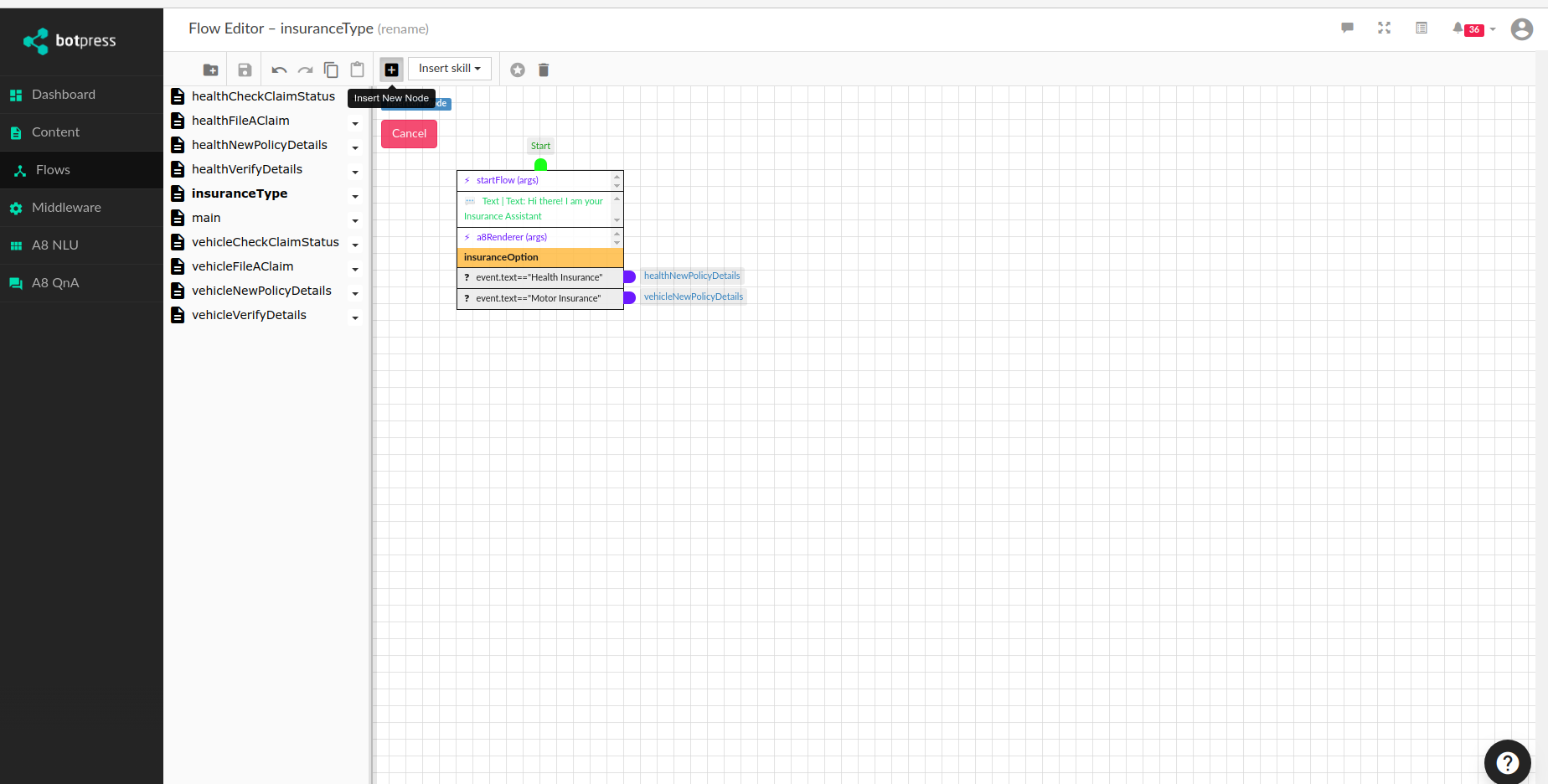

Add new node

Click + sign and click on the page to create a new node

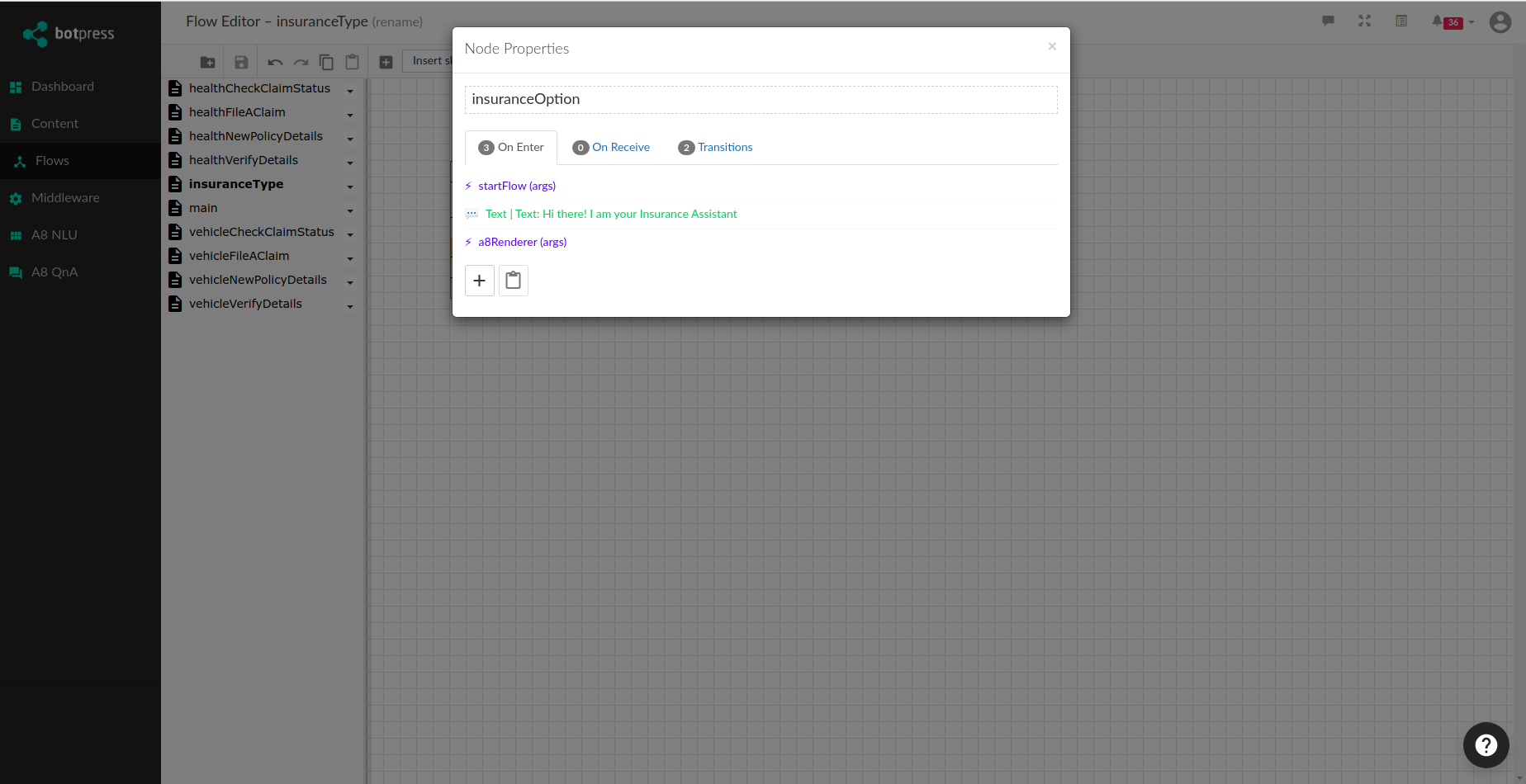

Configuring the Node

Double click the node and configure startflow. Startflow has to be configured only if the node is in start node, else it is not required.

On Enter Tab configuration

Configure to start flow

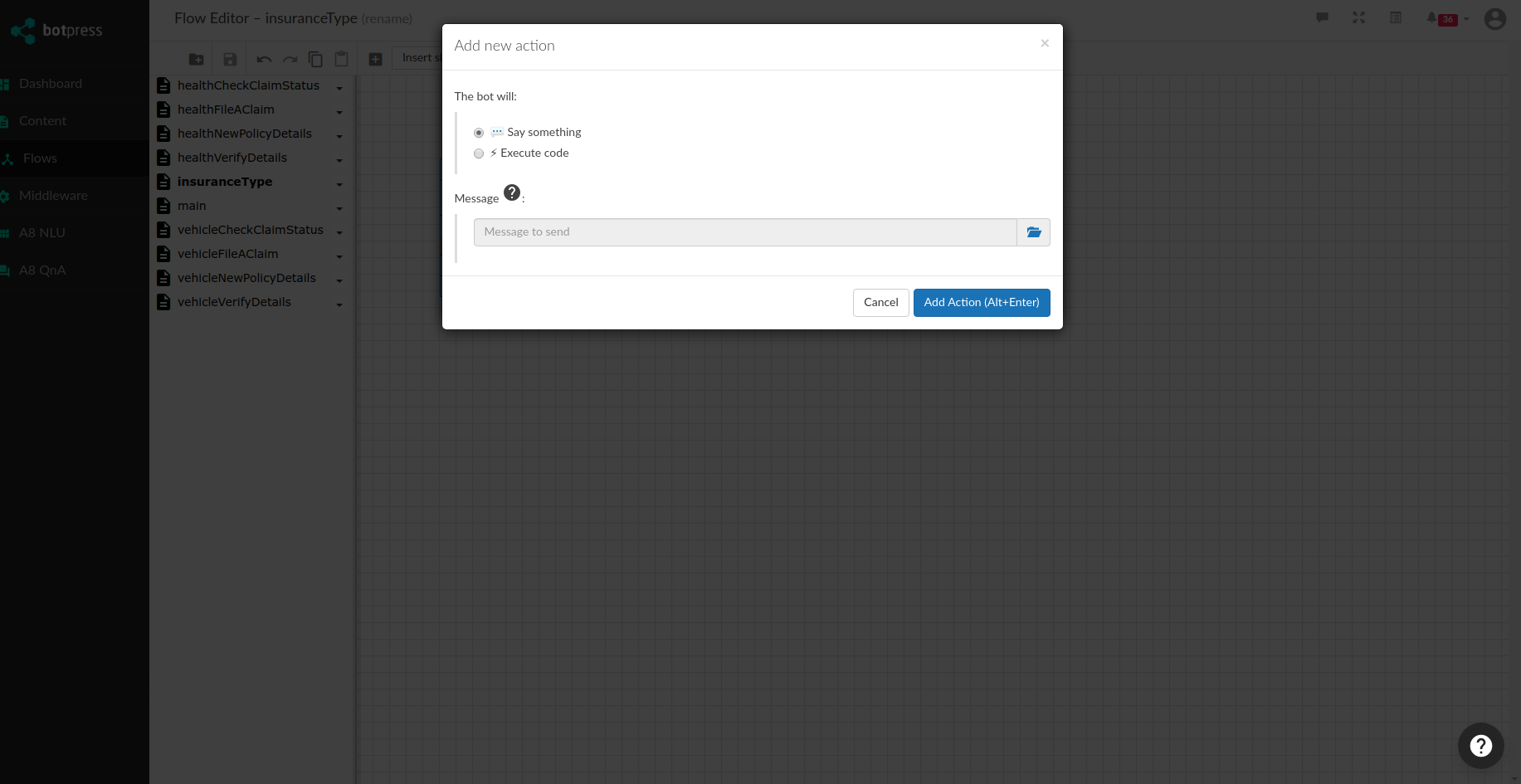

Step 1: Click on the + sign to add a new action.

Step 2: In the bot will, select Execute Code and Action to run dropdown list. Click start flow.

Step 3: Click on Add Action. For start flow there is no need to pass any parameters.

Configure on load message

Step 1: Click on the + sign to add a new action.

Step 2: In The bot will, the default option selected is say something.

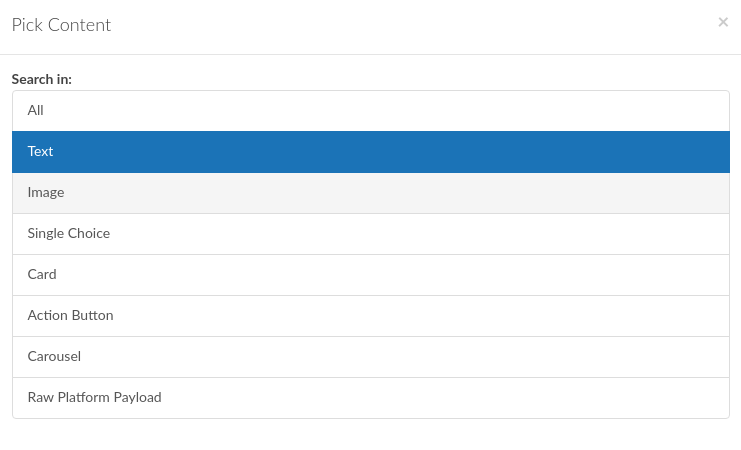

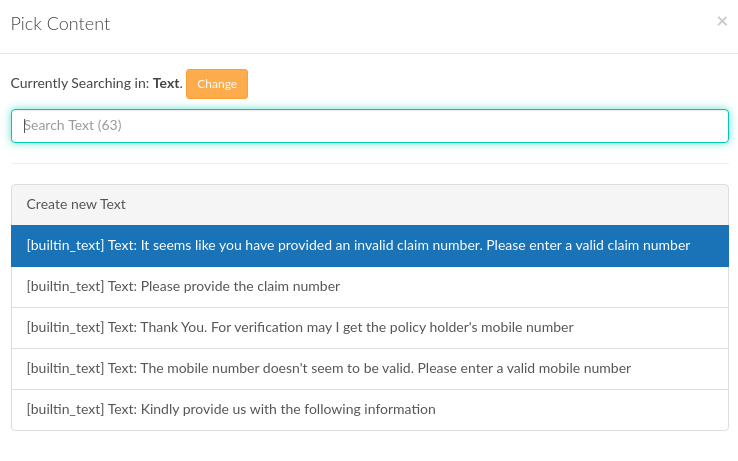

Step 3: In Message, click the folder icon. Select type as Text and click Create new text.

Step 4: A dialog box to enter text will appear; enter a load message and click Submit.

Configure A8 Renderer

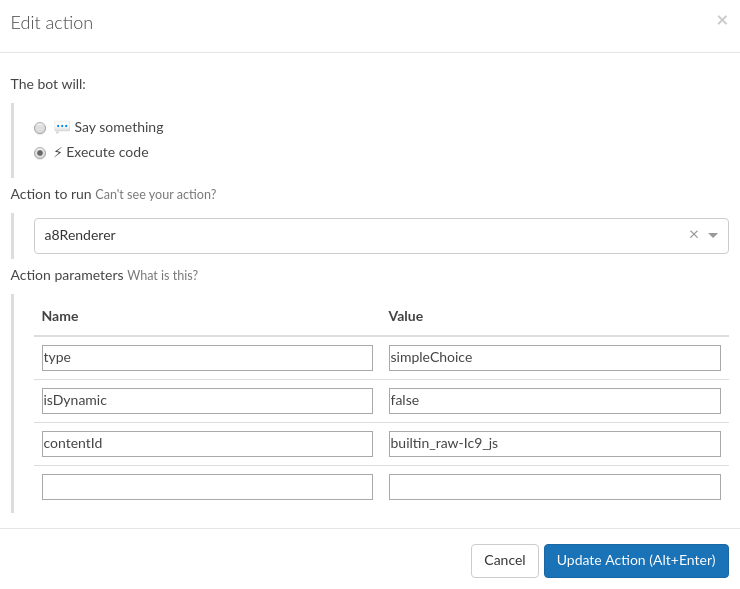

Step 1: Click on the + sign to add a new action.

Step 2: From the two options in the bot will, select Execute Code.

Step 3: In Action to run dropdown list, select a8renderer.

Step 4: Add parameters as required. For eg: In Content ID, you need to mention the ID from raw payload that was created in Step 1.

Step 5: Click Add Action.

Configure for menu options

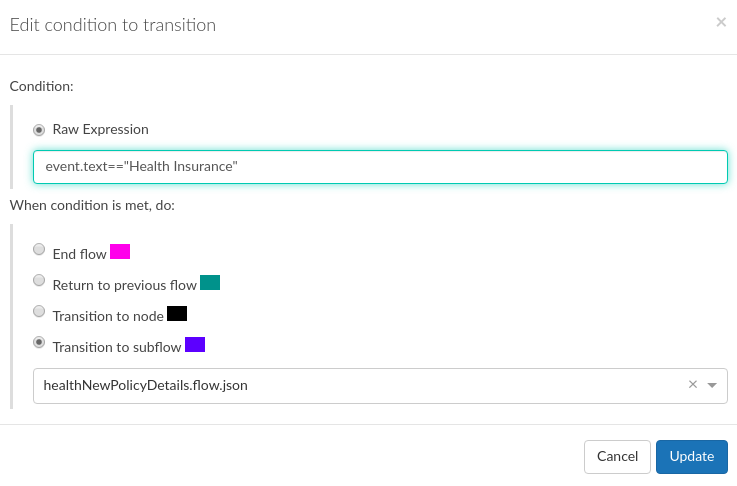

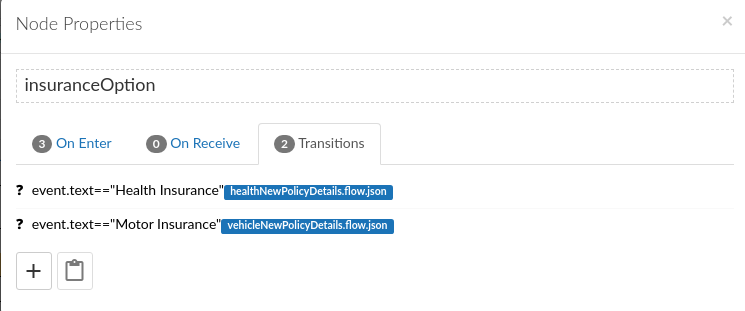

Step 1: Double click the node, click Transition tab. Select + and configure the New condition to transition.

Step 2: Raw Expression will check the user selection against the menu option. The name in Raw Expression should be same as the name mentioned in JSON script in the Raw Platform Payload section.

Step 3: In When condition is met, do, select the Transition to subflow and from the dropdown list map the particular subflow. This option will navigate the user to the next flow.

Step 4: Click Create.

The above steps have to be followed for all the menu options. Below are the screens for reference.

On Clicking update (in case of edit) and Create (in case of new creation) the below screen will be visible.

API Integration

Here, we are considering a scenario where OTP needs to be verified in order to intergrate the OTP service as a part of the flow.

For instance, user selected Health Insurance from the main menu and clicked Verify Claim Details. To verify the claim details, the user will be requested to enter the claim number and claim number will be validated to check if it is in the specified format of CLM_XXXXX i.e. CLM followed by 5 digits. After validation, the user will be verified using OTP Authentication service. Once OTP is verified successfully, the claim status will be displayed. Here we have configured the chatbot to display a static message to the user.